Monday, May 30, 2005

Chicago Goes to Omaha, BRKB Valuation, Berkshire Hathaway Bank, etc

So I am biased and point out headline #1 below, about last week's trip to

Buffett Group Meets its Namesake

Chicago Business Online (subscription) -

Warren Buffett, Chairman of the Board of Berkshire Hathaway and the second-wealthiest person in the world, met with 80 GSB students in an event organized by ...

Figuring Buffett's Worth

Motley Fool - USA

Spring is a wonderful time of year: Birds sing and flowers bloom -- and Warren Buffett, Chairman and CEO of Berkshire Hathaway (NYSE: BRKa)(NYSE: BRKb ...

Warren Buffett's Invisible Empire

BusinessWeek - USA

For years, Warren E. Buffett has been selling us everything from Dairy Queen sundaes and Fruit of the Loom briefs to Benjamin Moore paint and skillets from The ...

AIG/Gen RE

Berkshire Hathaway Cuts Ties With Ex-Exec

Forbes - USA

Berkshire Hathaway Inc. has severed ... chief executive. Officials at Berkshire Hathaway were not immediately available for comment Friday.

A Finger on the Pulse of Berkshire Hathaway and Warren Buffett

Throughout the spring, the snowballing financial scandal at insurance giant American International Group has put the spotlight on the firm's partner in the improper deal, General Re Corp. Could the damage extend to Gen Re's owner, Berkshire Hathaway Inc. and its legendary chief, Warren Buffett? The questions about Gen Re come on top of another that gets larger every year: Can Berkshire continue to deliver outsized returns to shareholders after 74-year-old Buffett, who has run the company for four decades, passes from the scene?

Currency

Buffett's Big Bet

Forbes: The Oracle of Omaha bet on a falling dollar, but it's starting to rise.

Warren Buffett Says He's a `Bull' on British Pound (Update3)

Bloomberg –

Pacific Corp Deal

Five Days Buffett Steps Up; Another Step Down for GM

New York Times -

... POWER PLAY After a long hiatus from deal making, Warren E. Buffett jumped back in, using some of the $44 billion in cash accumulated by his Berkshire Hathaway ...

Shark bait?

Sunday Herald -

... to the world in a surprise deal announced on Tuesday why ScottishPower had decided to sell PacifiCorp to

Business: Buffett Pays $5.1 Billion for Utility and Promises More Deals NYT By HEATHER TIMMONS and JAD MOUAWAD Warren E.

Business: Buffett Steps Up; Another Step Down for G.M.

By MARK A. STEIN

GOOD news abounded this week. Americans were all a bit wealthier, at least if they own homes; the economy grew faster, rebounding from a bit of a slowdown early in the year; and markets rose.

Other

Buffett's AAA Discount

Motley Fool -

I'd never attended before, so it was a tremendous thrill to meet Warren Buffett and Charlie Munger and let their wisdom massage my inner contrarian in person. ...

GEICO's Lean, Green Machine

Motley Fool - USA

... As Warren

Big Media Blues

Motley Fool -

... During the press conference at the recent Berkshire Hathaway (NYSE: BRKA)(NYSE: BRKB) shareholders meeting in

KSL-TV -

SALT LAKE CITY (AP) -- Billionaire investor Warren

Trip to Omaha by the Buffett Group, May 25, 2005

Hard to top two hours with Warren followed by a free lunch. Some pay $210,000, others pay group rates on Southwest to Omaha. Oh yeah, plus the cost of the Chicago MBA.

One of my favorite takeaways:

"If you had one silver bullet with the opportunity to kill one competitor, who would it be?"

"Progressive Insurance. And then I would shoot them again just to make sure they were dead."

[Laughter ensues around lunch table]

"That said, if you really want to get to know the business economics of an industry, that is one of the best questions there is, coupled with another, being 'If you had to choose only one competitor to compete against, whom would it be?' I did that once, going around to ten CEOs in the coal industry, and by the time I was done, I knew the industry economics."

Thursday, May 19, 2005

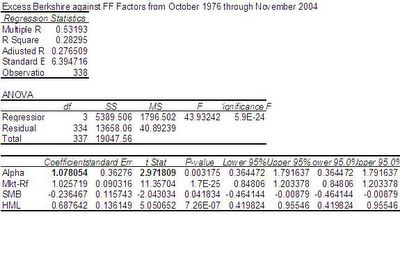

Courtesy of group member Jayson Noland -- you'll need a little background in Fama French here (HML - high book to market ratios minus low book to market ratios -- e.g. long value short growth, SMB, long small cap short big cap): Peter Lynch was not a value investor based on his t-stat on the HML loading that was calculated in class (only 0.5073 t-stat, not different from zero). Lynch had a very high loading on SMB (a 9.75 t-stat) and a high loading on the momentum factor (3.86 t-stat). Therefore, he was more a small-cap momentum investor than a value investor.

As Warren E. Buffett was named in the article along with the value investing imposter P. Lynch (and with an upcoming trip to Omaha), we decided to make certain the Buffett Clubs namesake is what he claims. With Berkshire monthly returns from October 1976 through November 2004 and data from the Frenchs site, we ran excess Berkshire returns against excess market and a 3-factor model. The CAPM results show a highly significant, monthly alpha of about 1.5 (note to readers: MONTHLY alpha over ~30 yrs!) Enticed by the 0.74 beta, we ran excess Berkshire against FF finding a significant, monthly alpha of about 1% and a big, positive, significant loading on HML. We also see a negative SMB beta suggesting that WEB is a large-cap value investor. Nice to know our $175 tickets on Southwest to Omaha and back will be money well spent.

We ran a few other regressions (not shown) to see how WEB has fared over the years. Berkshire's alpha does fall a bit as we advance in 10-year blocks to the present. Of course, Berkshire didn't fare incredibly well during the most recent 10-year period as the technology boom had an impact, though we still find a positive (insignificant) alpha. The graph in post below shows Berkshire returns less the market on a monthly basis. Not to shabby for a Nebraskan in a bad suit.

Wednesday, May 18, 2005

Gross on 10yr Yields and Buffett on Non-Proliferation

Damn interesting day I would say. First Bill Gross pulls a Kirk Kerkorian and reminds the electronic herd and the news media (and myself), who all thought rates had only one way to go, that they don't. 3-4.5% predicted near term for the Ten Year US Bond. Go figure.

If we had to forecast (and we do), we believe a range of 3 - 4½% for 10-year nominal Treasuries will prevail during most of our secular timeframe and that yields on Euroland bonds will be slightly lower due to their structural unemployment problems, disinflationary incorporation of new Central and Eastern European countries into their existing family of nations, and more growth-inhibiting demographics.

Maybe Sam Zell is right on Monday night at

"Paying whatever sum to stop the proliferation of nuclear weapons would be the deal that makes it look like we overpaid for the

Annual Meetings Revisited, Budweiser in Omaha

Good set of notes from Morningstar's Dreyfus Neenan with links summing up BRK and WSC meetings from earlier this month. Comment on hurricane season. While losses may come through, would be good for pricing environment long term. Motley Fool on Budweiser, Fortune on finite insurance, Business Week on SEC investigation (never get regulatory bodies competing over you for headlines -- ouch!), a pretty funny article about old crotchety men upending the young hedge fund upstarts on Wall Street (Kirk, Carl, Warren, etc), and at end a good article on the growth of Clayton Homes -- a compelling story for any business facing difficult lending conditions but with opportunities for growth. An address in Omaha might make a good corporate headquarters. GSB Buffett Club heads to Omaha next Wednesday to meet with the Oracle. Last year he served Coke. This year, Budweiser? A true value investor can only hope of sharing a Bud with the Oracle...

Roundup of the Berkshire Hathaway Meetings

by Dreyfus Neenan |

You can often learn a lot simply by watching. So at the 2005 ![]() Berkshire Hathaway BRK.A BRK.B annual meetings--the shareholder meeting in Omaha, the subsequent analyst/news briefing (which is not open to the public or shareholders) and at

Berkshire Hathaway BRK.A BRK.B annual meetings--the shareholder meeting in Omaha, the subsequent analyst/news briefing (which is not open to the public or shareholders) and at ![]() Wesco Financial's WSC annual meeting in Pasadena, Calif.--we watched. And listened. We've parsed our notes and selected what we think were chairman Warren

Wesco Financial's WSC annual meeting in Pasadena, Calif.--we watched. And listened. We've parsed our notes and selected what we think were chairman Warren

The King Is...Slipping

Motley Fool -

... Keep in mind, however, that

Berkshire: 2 insurance workers put on leave

BusinessWeek -

... placed on paid leave effective Monday as federal officials conduct probes into insurance practices, billionaire investor Warren

By Andy Serwer

The geezer billionaires who are upending Wall Street.

By Daniel Gross

... Following the 2003 merger with Warren

Friday, May 13, 2005

Wesco Annual Meeting Notes

Thursday, May 12, 2005

Buy Berkshire, it's cheap?

Interesting comments from the Fool discussion boards, plus an article. Of note, article one about undervaluation. The Day 1,2,3 are hilarious photojournalism. Too much detail…

Day 2 -- The Annual Meeting

Day 2 -- After the Meeting

BUFFETT'S MONEY NO GOOD ANYMORE?

With so much capital chasing any equity with a pulse, prices are too high for

More General Re Mess, Motley Fool on DCF, and Gates on Tech Valuation

SEC May Pursue More General Re Officials, Person Says (Update2)

Buffett by Numbers

Motley Fool -

Want to invest like Buffett? We derive the method Buffett uses to analyze the quantitative worth of a company. By Jim Schoettler. ...

Risky Business?

Motley Fool -

... Markowitz may have won a Nobel Prize, but Warren

Buffett turns into prophet of doom

The Sunday Times -

... This crowd was more soberly attired. Shivering on an unseasonably cold morning, they were here to see Warren Buffett, the world's most successful investor. ...

Gates' Non-Storm Stirs Tech Contrarians

TheStreet.com -

... valuations. His response: Well, I think any statement about stock prices is always suspect unless it's made by Warren

On the Road: Business Jets Are Back, if They Ever Went Away,

By JOE SHARKEY Published:

Oil, schmoil, many users of business jets appear to be saying. According to Richard T. Santulli, many business-jet users are simply looking at the added cost of fuel "relative to the cost of the trip or the charter itself" and saying: "Hey, what's another 500 bucks?"

Buffett Takes Radio Margaritaville To The Sky

Billboard Radio Monitor - New York,NY,USA

Singer, songwriter, best selling author and former Billboard reporter Jimmy Buffett and Sirius have announced that Buffett's Radio Margaritaville, which has ...

Quarterly Results, SEC Charges, Bill Miller and Jeremy Grantham

Headlines: 1Q results, insurance purchase from GE mentioned at Annual Meeting (Medical Protective, a 106yr old company that owns the dentist malpractice market and based in

Berkshire Hathaway 1Q Profit Falls

Washington Post - Washington,DC,USA

NEW YORK -- Berkshire Hathaway Inc., the insurance giant run by billionaire Warren

Buffett to pay $825M for GE insurer

CNN -

An Executive at Berkshire Faces Charge From S.E.C.

By TIMOTHY L. O'BRIEN Published:

Berkshire Hathaway, the company controlled by Warren E.

May 7 (Bloomberg) -- Warren

Buffett's Talk of Dividend Sends Daunting Message: Chet Currier

Bloomberg -

Berkshire Profit Falls 12% on Buffett's Currency Bet (Update3)

Bloomberg -

Annual Meeting Notes, Commentary, Investigations, and Long Lost Cousin Jimmy -- Front Page News!

So I and a few other hearty

“I’M

Notes From The 2005 "Woodstock of Capitalists"

The oracle speaks: Warren Buffett and Charles Munger warn of real estate 'bubble,' the risk of terrorist nukes.

CNN: Text from annual meeting…

From The Economist Global Agenda

Economist -

But Warren

Other of Interest:

Greenspan or Buffett? Asia Mulls Who's Right: William Pesek Jr.

Welcome to Miller Time, Loser. The great American beer crisis. By Daniel Gross

Reporters' Notebook: Follow the Acme Brick Road

By KAREN RICHARDSON of The Wall Street Journal and ALISTAIR BARR of MarketWatch

Munger-isms, grumble-isms

World's two richest men help guide Berkshire

Seattle Post Intelligencer -

... Warren

In Buffett they trust as they buy and hold

Houston Chronicle -

... and hold" investing. It's the strategy of Warren Buffett, one of the world's richest men and its foremost investor. Last weekend ...

General Re has been troubled acquisition for Buffett

Investor's Business Daily (subscription) -

4 tough questions for Warren Buffett

MSN Money -

... Among other highlights, attendees sample the wares of many

Buffett can expect bumpy ride ahead

Stuff.co.nz -

... Andrew Main writes. Investment legend Warren Buffett will shortly confront one of the most difficult dilemmas of his career. He will ...

Can newspapers escape Warren Buffett's gloomy prediction?

Yeald -

Warren Buffet is a longstanding director and shareholder of The Washington Post. Yet, he isn't exactly touting his newspaper investment. ...

NetJets Pilots to Picket Meeting of Berkshire Hathaway ...

Business Wire (press release) -

...

Wednesday, May 04, 2005

"It's class warfare, my class is winning, but they shouldn't be. .."

Warren does a post Annual Meeting sit down with Lou Dobbs. (The video is here.) The usual topics came up: nukes, twin deficits, import certificates, weakening dollar, overvalued markets, social security vs. the current deficit, estate tax, AIG, etc. Mostly sobering thoughts, but we did end on this happy note:

"I think it's a terrific country...You never want to go short on America...Our children, our grandchildren are going to live better than we do in this country. No question about it in my mind."

And lest you be concerned about Warren being able to survive on his $100,000 salary, he revealed that he is pulling down $1700-$1900 monthly in social security.

Tuesday, May 03, 2005

The Buffett Group take in the sights and sounds at the annual meeting. There were a lot of Columbia students, but we had better signage.