Thursday, May 19, 2005

Courtesy of group member Jayson Noland -- you'll need a little background in Fama French here (HML - high book to market ratios minus low book to market ratios -- e.g. long value short growth, SMB, long small cap short big cap): Peter Lynch was not a value investor based on his t-stat on the HML loading that was calculated in class (only 0.5073 t-stat, not different from zero). Lynch had a very high loading on SMB (a 9.75 t-stat) and a high loading on the momentum factor (3.86 t-stat). Therefore, he was more a small-cap momentum investor than a value investor.

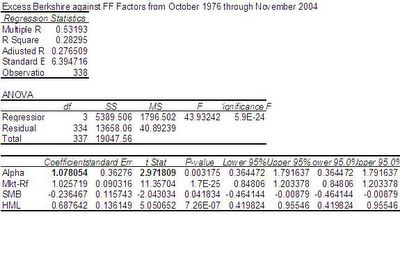

As Warren E. Buffett was named in the article along with the value investing imposter P. Lynch (and with an upcoming trip to Omaha), we decided to make certain the Buffett Clubs namesake is what he claims. With Berkshire monthly returns from October 1976 through November 2004 and data from the Frenchs site, we ran excess Berkshire returns against excess market and a 3-factor model. The CAPM results show a highly significant, monthly alpha of about 1.5 (note to readers: MONTHLY alpha over ~30 yrs!) Enticed by the 0.74 beta, we ran excess Berkshire against FF finding a significant, monthly alpha of about 1% and a big, positive, significant loading on HML. We also see a negative SMB beta suggesting that WEB is a large-cap value investor. Nice to know our $175 tickets on Southwest to Omaha and back will be money well spent.

We ran a few other regressions (not shown) to see how WEB has fared over the years. Berkshire's alpha does fall a bit as we advance in 10-year blocks to the present. Of course, Berkshire didn't fare incredibly well during the most recent 10-year period as the technology boom had an impact, though we still find a positive (insignificant) alpha. The graph in post below shows Berkshire returns less the market on a monthly basis. Not to shabby for a Nebraskan in a bad suit.